A group of investors is urging an Antiguan court to remove a British accounting firm appointed to collect assets of a Caribbean offshore bank at the center of an alleged Ponzi scheme by Texas financier R. Allen Stanford.

Martin Kenney, a lawyer for the group led by Florida businessman Alexarnder Fundora, said his clients have asked the High Court of Antigua to remove Vantis Business Recovery Services as liquidator because a Canadian court found earlier thiS year that 1t had deleted data from computers 111 the Montreal branch of Stanford International Bank Ltd.

“In order to recover and apportion the bank’s assets in the fairest and most efficient way possible for the victims of this apparent grand fraud, it is crucial to have Vantis removed and replaced as soon as possible,” Kemey said Friday from the British Virgin Islands.

Vantis was appointed by Antiguan authorities to liquidate the assets of Stanford International Bank. A spokeswoman for the firm did not immediately return a telephone call Saturday.

Kenney said that Vantis wiped out original data on computers in the Stanford bank’s branch in Montreal, Quebec, in March, without the authority of the Canadian courts and without notifying the Quebec financial regulator.

The Superior Court in Montreal ruled in September that Vantis deliberately misled the court, destroyed original computer data, and removed financial information. Vantis operated with “questionable motives,” Judge Claude Auclair wrote in the Sept. 11 judgment.

The Canadian court subsequently replaced Vantis with Ralph Janvey, a lawyer appointed by U.S. courts to liquidate Stanford assets.

Vantis and Janvey have been fighting for jurisdiction over the assets, frustrating investors who are eager to recover money they invested in what U.S. authorities have alleged as a massive Ponzi scheme.

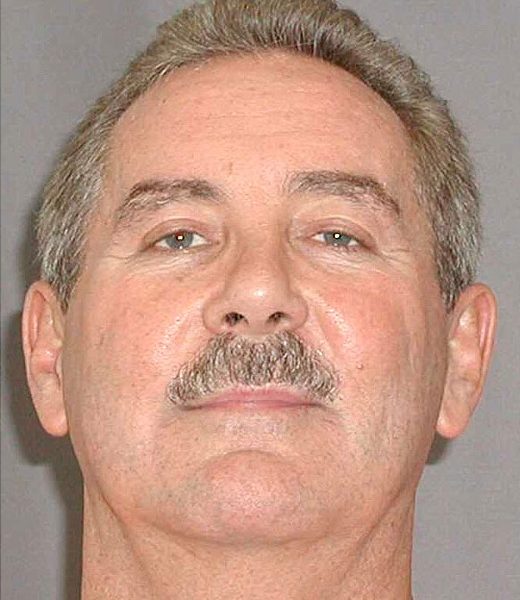

Stanford, once a benefactor of the Antiguan government, is in a Texas jai I awaiting trial on charges including money laundering and fraud.

Prosecutors accuse Stanford of leading a $7 billion Ponzi scheme by promising inflated returns to about 28,000 investors on certificates of deposits. The U.S. Securities and Exchange Commission said he instead used the money from new investors to pay off old ones. They also accuse him of skimming more than $1 billion to fund his lavish lifestyle.

Stanford denies the allegations.